Business Insurance in and around Hampton

Get your Hampton business covered, right here!

Helping insure small businesses since 1935

- Newport News

- Smithfield

- Langley

- Isle of Wight

- Norfolk

- Peninsula

- Williamsburg

- Yorktown

Coverage With State Farm Can Help Your Small Business.

When experiencing the challenges of small business ownership, let State Farm do what they do well and help provide outstanding insurance for your business. Your policy can include options such as extra liability coverage, errors and omissions liability, and worker's compensation for your employees.

Get your Hampton business covered, right here!

Helping insure small businesses since 1935

Protect Your Business With State Farm

When you've put so much personal interest in a small business like yours, whether it's a lawn sprinkler company, a yogurt shop, or a farm supply store, having the right insurance for you is important. As a business owner, as well, State Farm agent Taylor Ethridge understands and is happy to offer personalized insurance options to fit your business.

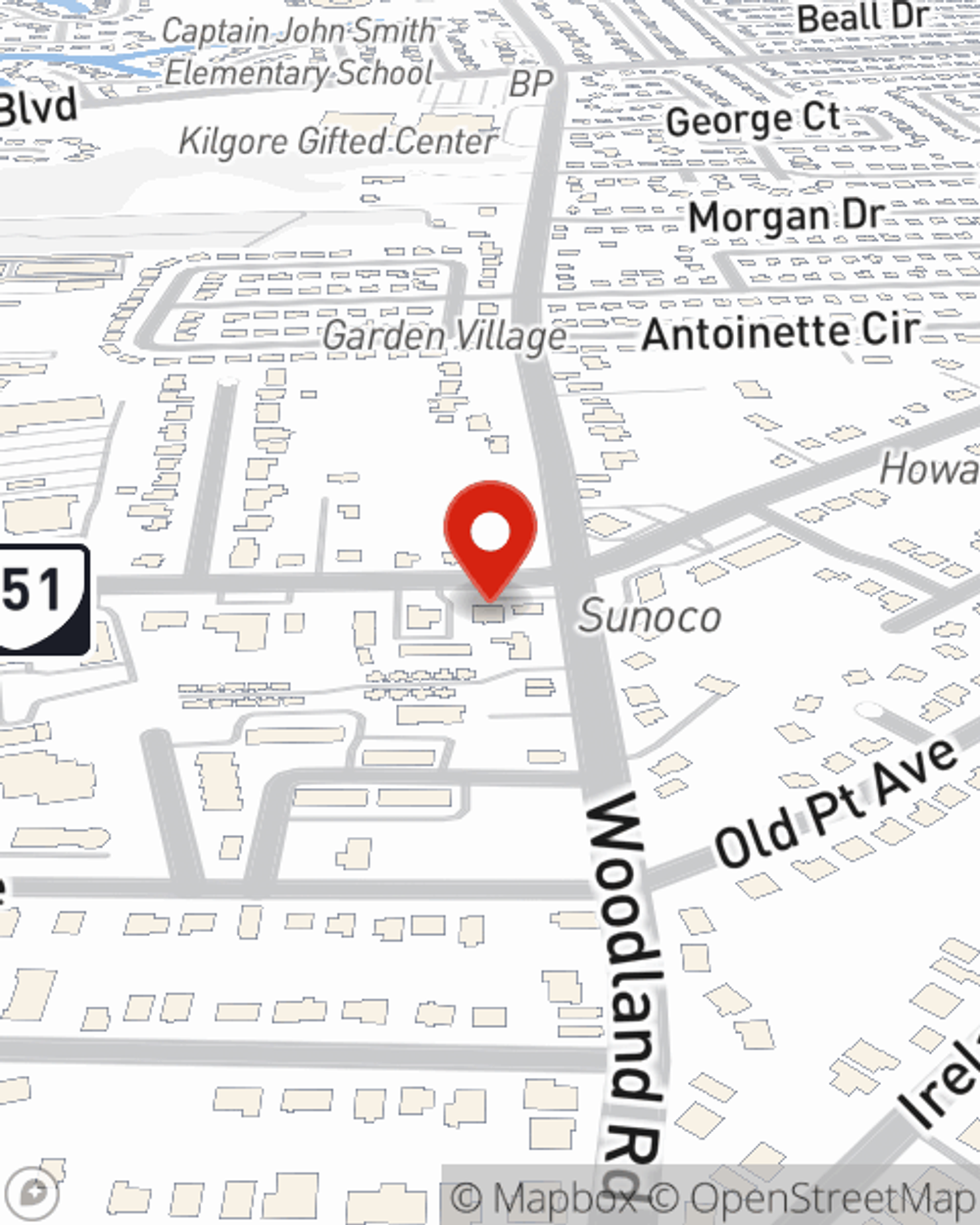

Ready to discuss the business insurance options that may be right for you? Stop by agent Taylor Ethridge's office to get started!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Taylor Ethridge

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.